There are two ways to save your tax money on your medical expenses. The first is by medical expense tax deduction, and the second is with your company’s flex spending plan.

If your medical expenses reach 7.5% of your income in any given year, the price of procedures and ophthalmic services not covered by insurance can be deducted for tax purposes. In May 2003, the IRS confirmed that laser vision correction is also qualified as a medical expense for this purpose. Most people, however, don’t end up reaching the 7.5% threshold. Therefore, they turn to another popular program – flex spending.

What is a flexible spending account? A flexible spending account (FSA), (also called a flex plan, reimbursement account, flex 125, tax saving plan, medical spending account, a section 125, or a cafeteria plan), is an employer-sponsored benefit that allows you to pay for eligible medical expenses on a pre-tax basis. If you expect to incur medical expenses that won’t be reimbursed by your regular health insurance plan, you can take advantage of your employer’s FSA, if one is offered.

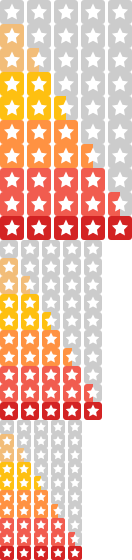

What are the benefits? FSA saves you money by reducing your income taxes. The contributions you make to a flexible spending account are deducted from your pay BEFORE your Federal, State, or Social Security Taxes are calculated and the contributions are never reported to the IRS. The benefit is that you decrease your taxable income and increase your spendable income which can save hundreds or even thousands of dollars a year.

How does flexible spending work? At the beginning of the plan year (which usually starts January 1st), your employer asks you how much money you want to contribute for the year (there are limits) into your flexible spending account. You have only one opportunity each year to enroll, unless you have a qualified “family status change,” such as marriage, birth, divorce or loss of a spouse’s insurance coverage. The amount you designate for the year is taken out of your paycheck in equal installments each pay period and placed in a special account by your employer. As you incur medical expenses that are not fully covered by your insurance, you submit a copy of the Explanation of Benefits or the provider’s invoice and proof of payment to the plan administrator, who will then issue you a reimbursement check.

What expenses are eligible? Any expense that is considered a deductible medical expense by the IRS and is not reimbursed through your insurance can be reimbursed through the FSA. This includes most elective surgeries, laser vision correction, deductibles, eyeglasses and prescription drug co-payments.